In my quest to understand the areas and markets where I work better I will be looking at some specific sales stats in those areas. The data used was acquired from the Lightstone programme and which is based on true Deeds Office Registrations data.

Having looked at the last 500 Sectional Title Property Registrations from March 2010 to Jan 2012 (+/– 23 per month) some interesting facts about sales prices and price per square metre revealed itself.

The data shows that smaller units, below 100sqm fetch a better price per square metre (R 8163) than bigger units over 100sqm which only fetched R 5969 per square metre. As an example, a 70sqm unit will sell for +/- R 560 000, a 120sqm unit for +/- R 770 000 and a 180sqm unit for +/- R 900 000 making the bigger units worth less per square metre. The bigger units are normally the ones with double garages and bigger rooms but yet they sell for less. The 500 units that registered during this time sold for an average of R 7276 per square metre with the smallest being 43sqm and the biggest being 198sqm.

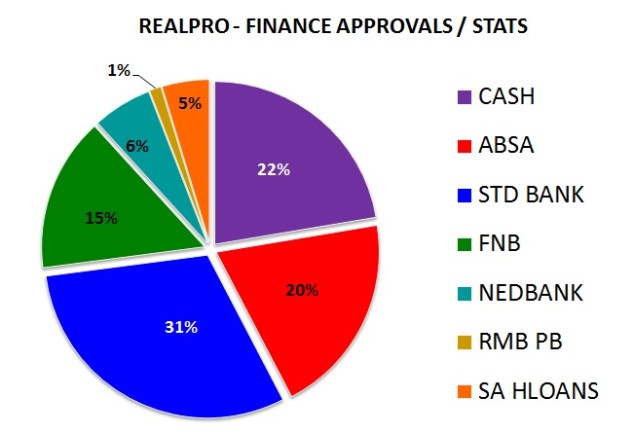

From the 500 transactions, 82% (408) got a Bond from one of the four major banks, Investec or SA Homeloans while 15% bought without a Bond. The other 3% got finance in other ways not specified in the reports. The average sales price of all the properties came to R 660 000 with the lowest being R 220 000 and the highest being R 1 100 000. The average sale for Bonded properties was R 615 000 and for Cash sales, R 630 000.

The 408 bonds came to a total of R 250 941 915 against a total purchase price of R 272 276 997, which is 92.16% financed. Although all the banks have different financing criteria most sellers need to prepare for a deposit of +/- 5% to 10%.

The major financial institutions financed 82% of the registered properties as follows:

Interesting to see SA Homeloans with 13% of the cut and Standard Bank granting the most loans (34%) for the specific period.

Other interesting stats from the sale of these properties came from looking at the three areas and the number of sales per area. Honeydew Manor had 6 (124) registrations, Honeydew Ridge had 137 (116) and Wilgeheuwel with 357 (89) registrations. The number in brackets is the average size of the units for that area. While I do think that Wilgeheuwel is the biggest area with the most amount of units, it also has the most amount of small units, bringing the average size down to 89sqm, your typical 2 Bedroom 1 Bathroom unit with a TV lounge and 1 Garage …. +/-. Note to self: Smaller units sell better than bigger units!

Average size for the 500 units came to 97sqm, average price R 660 000 as previously mentioned, which gives you R 6800 per square metre.

Looking at the average price for each area, Honeydew Manor comes in at R 792 000, Honeydew Ridge at R 728 000 and Wilgeheuwel at R 630 000.

Conclusion:

Well, as an agent this helps me to price my listings correctly according to size and area. It also helps me to know the areas better and what buyers are buying. As a Seller, it is just as important to know what your unit is really worth and what you can expect as over-priced properties are not selling and those that are priced right do! As a Buyer, looking at these stats will assist you in finding the value for money, not a steal, although those are out there. Knowing that you are buying at the right price.

Watch this space for more area reports and statistics such as this ………. enjoy, and remember to subscribe to my blog with your email address on my home page.

For all my properties, visit my profile on the RealPro website.

…. watch this space for more stats and info ….. all our properties can be viewed at www.realpro4u.co.za

…. watch this space for more stats and info ….. all our properties can be viewed at www.realpro4u.co.za