Prime Lending Rate – South Africa

What is a Prime Lending Rate? / https://en.wikipedia.org/wiki/Prime_rate

A prime rate or prime lending rate (PLR) is an interest rate used by banks, usually the interest rate at which banks lend to favored customers—i.e., those with good credit. Some variable interest rates may be expressed as a percentage above or below prime rate.

We had our first Monetary Policy Committee (MPC) meeting of the South African Reserve Bank last week. The MPC decided on 16 January 2020 to lower in Interest Rate by 25 basis points which meant that the PLR dropped from 10.00% to 9.75%. The next meeting date in scheduled for 17 to 19 March 2020.

The lower the PLR the less you pay on your bond, car finance etc, unless your rate is fixed on a fixed percentage with the financial institution. Lowering the Interest Rate is always seen as a positive move for the property market as this will benefit both Buyers and Sellers. Buyers will have a slightly reduced bond repayment which will affect their affordability profile. At the same price, Sellers will have more buyers who can afford their properties due to the reduced rate, etc etc. The difference in repayment of an average bond amount is very small, but this changes as the bond amount gets higher.

Example of bond repayments:

- R 1 200 000 bond on a house at Prime (9.75%) over 20 years will cost you R 11 382.20pm as a repayment. The same bond at 10.00% over 20 years would have cost R 11 580.26pm, a saving of R 198.06pm.

- R 5 000 000 bond on a house at Prime (9.75%) over 20 years will cost you R 47 425.84 as a repayment. The same bond at 10.00% over 20 years would have cost R 48 251.08, a saving of R 825.24pm

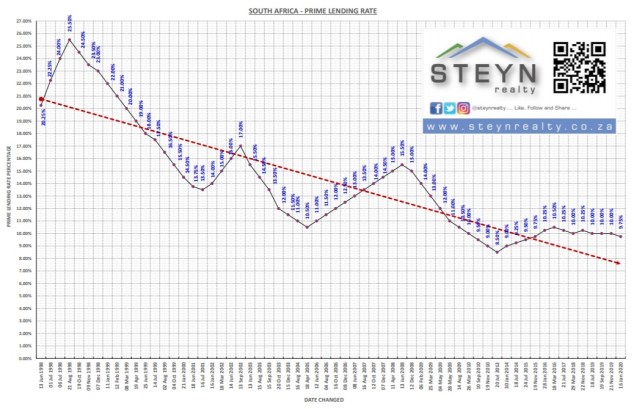

The attached PLR Graph shows the rate changes since June 1998, going up to 25.5% in August 1998 coming down sharply during the next 14 years with some spikes to 8.50% in July 2012. The last 10 years have been constant between 10.50% and 8.50%.

The biggest benefit to the MPC lowering the rate is that it creates a positive market sentiment which means that buyers and investors are happy to invest in property. The most important factor in the current market is still PRICE. We believe, as there are quite a lot of stock available that we are still in a Buyer’s Market and Sellers need to price correctly in order to get Buyers interested. “Over Pricing” is very negative as many over-priced properties never sell.

The time for making a killing on your property isn’t now. But if you are prepared to sell at a MARKET RELATED price and your property is priced accordingly, you will. Buyers will always negotiate but within reason if your price right.

2020 Have kicked off with a BANG and we hope that you will have great year. Looking to sell? Let us know, we would love to sell your property.

Juanita Steyn – 083 604 1231

Marnus Steyn – 072 264 7806

For all out stock, show-days, listings and news please go to www.steynrealty.co.za