To Fix or not to Fix …

No, this is not an article about property maintenance … … … there is a very different kind of fixing going on in the real estate industry.

As a homeowner with a bond repayment, you have the option of a variable / linked Lending Rate for your home loan repayment or you can apply to have the rate fixed at a specific level.

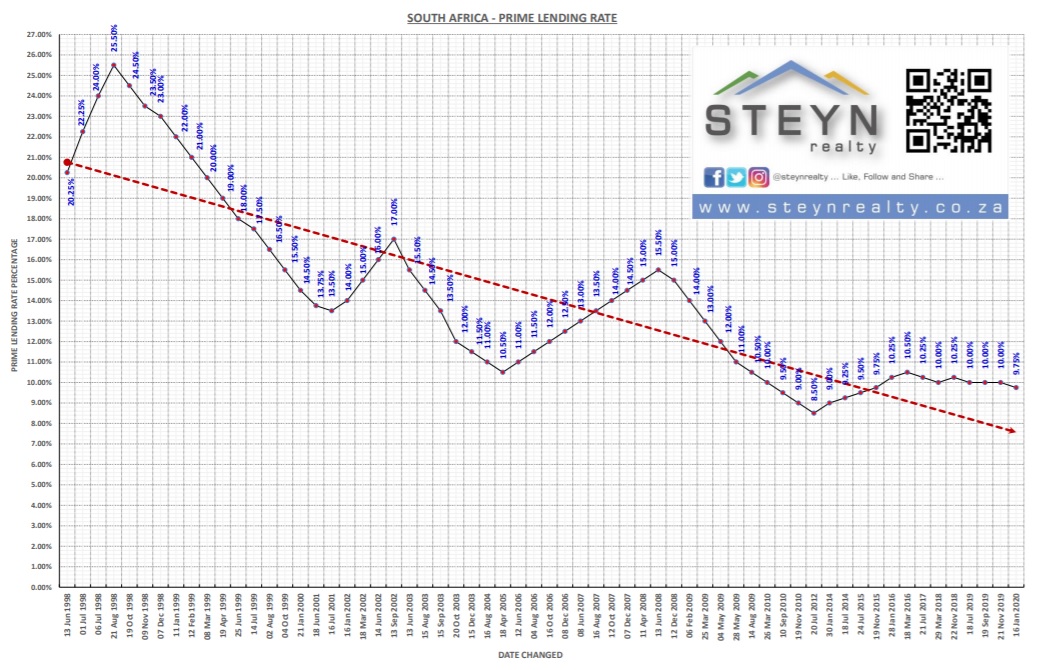

We recently asked Sanette Payne of Payneless Bonds (www.paynelessbonds.co.za) to share some info on this as this topic which frequently comes up in conversation with our clients. With the Prime Lending Rate being very low at 7.25% currently and said to reduce even further towards the end of the year, fixing your bond repayment rate might be a viable option for some homeowners.

Sanette had the following to say:

“We often get asked whether a fixed interest rate is possible. The banks used to offer fixed interest rates upfront on bond approval, but this has unfortunately been cancelled and now you can only apply for a fixed rate after registration of your home loan. It is important to understand that your fixed rate will be determined based on the period that the rate is fixed for and is generally significantly higher than your variable rate offered by the banks.”

In summary, by fixing your bond repayment rate, you protect yourself against future rises in the interest rate for the period that the rate is fixed but if the interest rate is reduced during the fixed period, you will lose out on any potential saving. All the banks have their own qualification criteria but in general, rates are fixed for between 12 to 60 months and at a rate of between 2% to 3% above the normal variable rate which is currently 7.25%.

To find out more about what your specific bank can offer you, here are some contact numbers supplied by Payneless Bonds:

ABSA: 0860 111 007

FNB: 087 730 1122

STD BANK: 0860 012 3001

NEDBANK: 0860 555 111

SA HOME LOANS: 0861 888 777

Please make sure that you get all the relevant info from your bank before you enter into a fixed rate agreement with your bank.

For all our stock, including photos, descriptions and virtual tours please visit our website or go to our YouTube channel where you can also subscribe to get all our latest videos. When listings with Steyn Realty, the standard services include:

- A detailed property value assessment including area trends.

- Professional high definition photos.

- Virtual tour posted to various websites as well as YouTube.

- Extensive web and social media exposure on various channels and platforms.

Please do not hesitate to contact us should you want us to assist you with the sale of your property. Our areas include all areas around Wilgeheuwel, Radiokop, Allen’s Nek, Strubens Vallei, Little Falls, Helderkruin, Constantia Kloof, Weltevreden Park, Ruimsig, Amorosa, Poortview, Tres Jolie etc.

Give us a call so we can chat.

Juanita Steyn on 083 604 1231 / juanita@steynrealty.co.za

Marnus Steyn on 072 264 7806 / marnus@steynrealty.co.za

Click for info:

Website: Click Here

YouTube: Click Here

Facebook: Click Here

Instagram: Click Here

Twitter: Click Here

The South African Reserve Bank’s Monitory Policy Committee will be meeting on the following dates to decide on the Rate adjustments going forward:

21 – 23 July – next week

15 – 17 September

17 – 19 November