It’s been a while ….. between listing, marketing and advertising properties, managing rentals, taking photos, trying to update all the websites, social media platforms and now lately YouTube as well ….. it’s difficult to find time to blog.

Since I last blogged we have been hit with Covid-19. Who would have through that one day, 26 March 2020, the country would be locked down due to a virus (more about my views on this later) but hey, this wasn’t a good experience, totally unforeseen and unplanned for. No work No pay as the saying goes ….

At least we had some deals in the pipeline and a couple of rentals to keep us going. Yesterday, 4 July 2020 saw 100 days since lock-down, at least we are able to work again and most people are getting back to the “new normal” bit by bit. Some of our tenants have been hit hard, not receiving salaries and some even losing their jobs all together. Not a nice situation to be in for anyone involved.

April & May 2020 was consumed by MARKETING! Not much else to do when you are sitting at home and you are not allowed to take out clients to see properties to buy or to rent. Once all the aspects and specifications of a specific property has been gone through and discussed with prospective buyers or tenants (which can be done telephonically or via other virtual platforms such as zoom etc) 99% of people want to SEE the property before making a final call. So except for marketing & communication not much could have been done during lock-down.

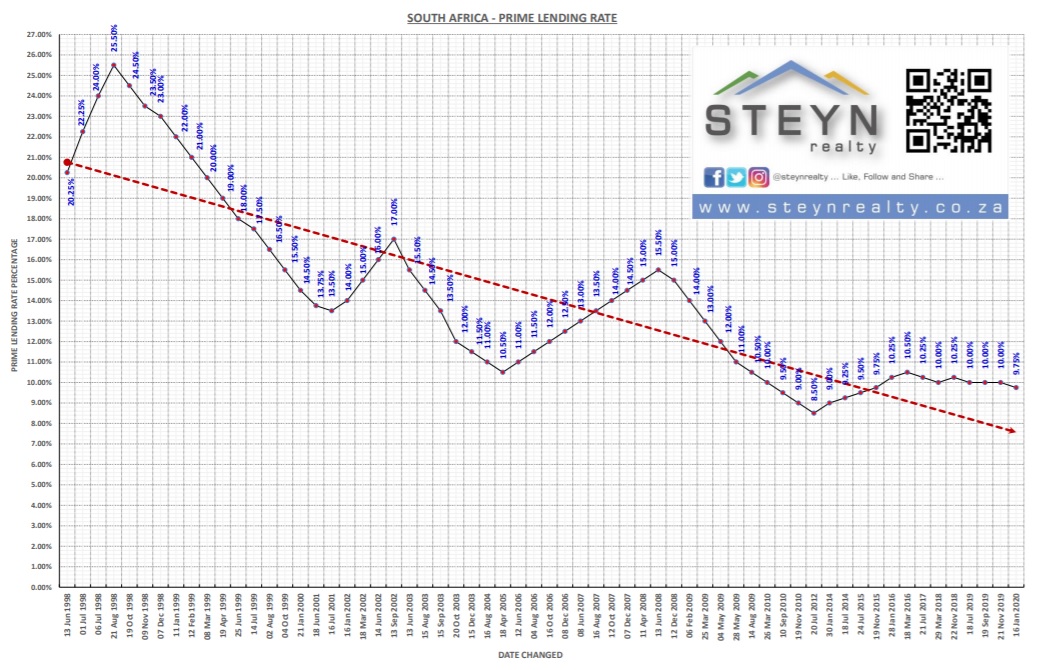

During this time, and in an effort to assist home owners with their bond repayments, the Prime Lending Rate has been reduced from 9.75% in Jan 2020 to 8.75% in March, 7.75% in April and the last interest rate cut was on 21 May 2020 where the Prime Lending Rate dropped to 7.25% ….. many reports are saying that we might see a further reduction towards the end of the year. This is the lowest rate that we have seen in more than 20 years. Can you believe that one of our Landlords even passed this saving onto the tenants as they knew the tenants were not able to earn an income during the lock-down period … … a fantastic gesture by the landlord to try and assist the tenant.

During this time we (Steyn Realty) have launched our new website through Entegral Technologies, http://www.steynrealty.co.za. We also got our YouTube channel off the ground where all our property videos, virtual tours and other will be posted and shared.

https://www.youtube.com/channel/UCLGbOvvPjY6zMh2kAQDhHTQ

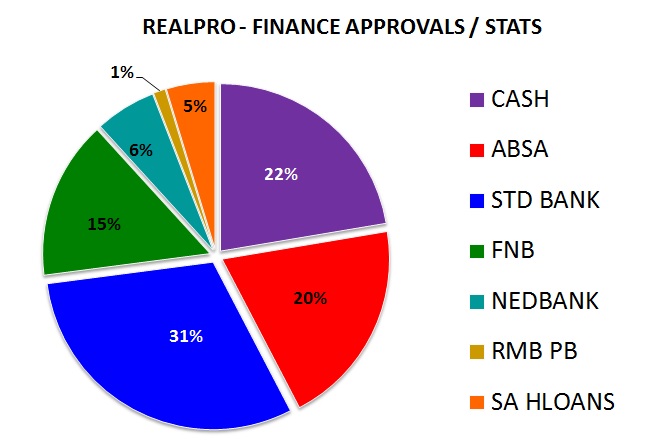

We are extremely fortunate and blessed to have concluded several sales since 1 June 2020 when the lock-down was relaxed to allow us to take out clients again, masked, scanned and sanitized, we had buyers lined up and it paid off.

Areas where we have recently sold properties include, Honeydew Ridge, Northcliff, Ruimsig and Wilgeheuwel in Roodepoort.

Due to these properties selling we now have buyers lined up for similar properties. We are urgently looking for SELLERS selling in the same areas as above between R 850 000 to R 2 500 000, 2, 3 and 4 bedroom properties, apartments, townhouses, clusters and houses.

If you are reading this and you are interested in SELLING, please give us a call. Our marketing plan includes professional photos, virtual tours and property videos, listings on Property24 as well as our own website which feeds through some smaller property portals. All social media platforms are included where our friends and followers can see, comment and share our listings.

Look out for more blog posts to follow on our recent sales, the affect of Covid on our market, the benefit of virtual tours and pricing right for the current market.

Your SALE is our GOAL.

Cheers for eers. Hope you have a stunning week ahead.

Marnus

0722647806