A resent article on Property24 highlighted the most important factors to consider when buying into a HOA (Home Owners Association). Herewith the article:

05 Jun 2012

Gated communities and private estates have become common place in South Africa mainly due to their perceived feelings of added security and safety. What most people might not realise is that each of these communities and estates are ruled by a Home Owners Association (HOA) that has their own set of rules and regulations with regards to what can and cannot be done.

Ask to see the most recent trustee meeting minutes – viewing the minutes will be able to give you an idea of the topics and issues that are current within the estate. “HOAs are often confused with Sectional Title Schemes or Bodies Corporate, and whilst the two are similar there are many differences,” says Johann Le Roux, Director of Propell.

Before buying into a gated community or private estate, Le Roux advises that you ask the following questions with regards to the HOA for that estate:

- Make sure you know what the HOA rules and regulations are. For example are you able to sublet any parts of your property or run a business from your property? What are the styles and colours allowed? Are you allowed pets within the estate; and if you are allowed dogs, must they be walked on a leash when out in the common area? If you are unsure of any of the rules and regulations stated, seek legal advice.

- What is the financial standing of the HOA? Is the HOA currently in the black? Does it have any monies saved for future projects? What are the current levies and when last were they increased?

- What is the arrear levy collection policy? Obtain a list of arrear owners to establish if there are significant arrear balances, which could impede the HOA’s cash flow.

- Ask to see the most recent trustee meeting minutes – viewing the minutes will be able to give you an idea of the topics and issues that are current within the estate.

- Find out if there are any penalties for not building within a specified time period – this especially applies to estates where you buy your plot and then build. The penalties for not building within a specified time period have been known to be as much as 8 times what the current levies are.

- Make sure the home/property that you are buying is not already out of compliance with the HOA regulations.

- What do your levies cover? For example – security, road maintenance, path maintenance, fences, public areas such a pool, club house, etc.

The main advantage of living within an HOA is the lifestyle opportunities they offer, says Le Roux ……

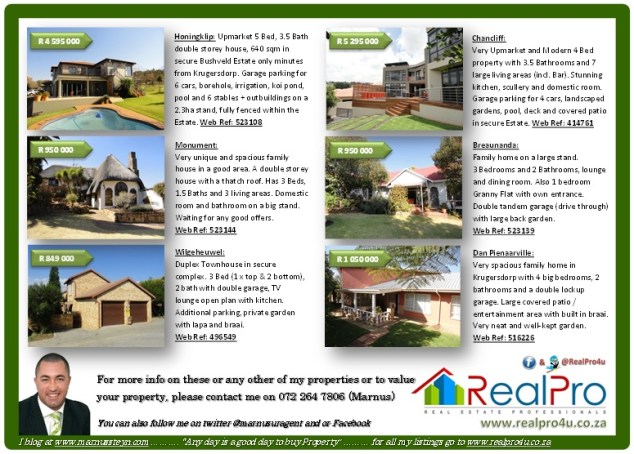

A couple of examples in the areas where I sell.

- Townhouse in Wilgeheuwel,Roodepoort for R 489 000

- Townhouse in Rangeview, Krugersdorp for R 599 000

- Townhouse in Wilgeheuwel, Roodepoort for R 850 000

- Townhouse in Wilgeheuwel, Roodepoort for R 925 000

- Cluster in Chancliff, Krugersdorp for R 1 140 000

- Cluster in Chancliff, Krugersdorp for R 1 355 000

- Cluster in Strubensvallei, Roodepoort for R 1 750 000

- House in Estate, Ruimsig, Roodepoort for R 2 500 000

- House in Estate, Ruimsig, Roodepoort for R 2 750 000

- House in Estate, Chancliff, Krugersdorp for R 5 259 000

Just to point out that most the advice given above is also applicable when buying into a Sectional Title (‘ST’) / Townhouse development with the major differences being:

- Most ST developments are managed by a property management company.

- Properties are mostly refered to as Townhouses or Flats where HOA’s are Clusters and or Single Residential Properties within an Estate.

- These Townhouses do not have their own Erf numbers which is covered by one Erf number for the development as a whole.

- Owners do not own the stand / land on which the property is built but only the inside of the building.

- Owners therefore own a share in the development depending on the size of their unit ……… and so we can go on.

The ST developments appoint a board of trustees made up of owners and also have audited financials, rules and regulations, annual general meetings where budgets and levies are discussed and minuted. Some even have regular news letters sent out to owners / residents which can all be obtained prior to signing on the dotted line. Agents selling any of these properties should also be able to provide you with such info where requested.

Additional monthly expenses that you need to be aware of are:

- Levies + additional levy for security where applicable (some complexes have this included in the current levy but this is not always the case). Levies normally include payment for services such as: upkeep of common property, garden services, refuse removal, general maintenance to the common property as well as to the exterior of the units, security services and maintenance to gate motors, systems etc, structural insurance (replacement value) including repairs and replacement of geezers, windows, walls, roof structures etc.

- Rates and Taxes paid to the relevant council.

- Water and electricity usage (Some developments might have these on a pre-paid system) normally included on the levy statement.

- Any special levies imposed by the Body Corporate for maintenance, upgrades etc.

What is very important is to make sure that when you buy into any of these Developments, Complexes or Estates, that any additions, alterations or improvements of any sort has been approved by the HOA or Body Corporate and the Council where applicable.

Just as buying any property, you as the buyer have to make sure that you took all necessary steps to gain as much info on the relevant property that you want to buy that you are comfortable going forward with the sale.

Just remember …… “Any day is a good day to buy Property”!

Marnus